Summer is usually a slow season in the health insurance policy world. But not summer 2022. A lot is happening, and I want to keep you updated on all of it. I appeared on WRKF Radio’s Talk Louisiana with Jim Engster on Monday, Aug. 15. We talked about what’s going on in the health care world.

This post is a condensed version of that conversation. You can listen to it here (44:27 – don’t worry; I am not the whole segment.

The Inflation Reduction Act and Health Care

President Joe Biden signed the Inflation Reduction Act on Tuesday, Aug. 16. You wouldn’t know it from the title, but the new law has provisions that will affect the health care and health insurance industries. There are two major changes in the Inflation Reduction Act I want you to know about.

ACA Subsidies

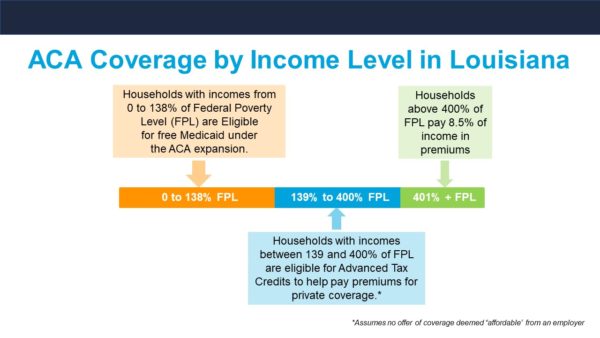

Early in 2021, Congress passed the American Rescue Plan Act (ARPA). As part of that law, people buying health plans on healthcare.gov were given an opportunity to draw down MUCH larger tax credits than had ever been available. This has the effect of reducing premiums for folks at almost every income level. Prior to ARPA, tax credits cut off completely if your income was 400% of the Federal Poverty Level (roughly $50,000 a year for a single person). The new ARPA version of the tax credits went far beyond that income level, essentially changing the cut-off to allow you to pay no more than 8.5% of your income in premiums — at any income level. These figures are based on buying a benchmark Silver plan on healthcare.gov.

This graphic illustrates how federal subsidies and asset-tested premium limits work.

This change came with a high price tag. The money Congress originally appropriated for this increased financial assistance to help more people buy health plans was set to run out in December 2022. This would have left about 6 or 8 million people nationwide without health insurance. But as part of the Inflation Reduction Act, Congress extended those enhanced tax credits through 2025. It’s a big deal. It costs about $20 billion a year to do this, but folks who have healthcare.gov coverage because of those more-generous tax credits are going to be able to keep the same level of assistance for another three years. In Louisiana, 25,000 people or so are going to benefit directly from that change.

As a reminder, if you are shopping on healthcare.gov, be sure to put in your ZIP code because the plans and the subsidies vary from county to county, from parish to parish. Based on the way the feds set up the marketplace, it is entirely possible for a person who’s single and has an annual income of around $20,000 – $-$30,000 to get a health insurance plan with a $0 premium. Now, having said that, you need to check the deductibles, copays and coinsurance to make sure you can afford to use that free insurance, because you may find significant cost-sharing. It may be worth your while to pay a little bit more in premium. It could drastically reduce your out-of-pocket costs while you’re using the plan.

Medicare and Medicaid Drug Price Negotiations

Another important aspect of the Inflation Reduction Act is allowing Medicare and Medicaid to negotiate the prices they pay for prescription drugs for the first time. This may be the biggest achievement of the entire bill. Previously, the federal government would not allow itself to negotiate with pharmaceutical companies over the prices of drugs. They would just pay whatever they were asked and negotiate rebates if they thought the price was too high. Now, for the first time, Medicare and Medicaid has been given the authority to negotiate directly for the most expensive drugs Medicare members use. The plan is to identify the 100 most-expensive drugs and negotiate deals on 10 of them every year for the next 10 years.

Additionally, the Inflation Reduction Act changed retiree drug plans. Starting in 2025, they will have a maximum annual out-of-pocket for consumers of $2,000. That’s big, especially since older individuals tend to have more health needs and take more prescription drugs – often while living on a fixed income if they’re retired.

Medicare Price Caps on Insulin

Another big move on the drug front in the Inflation Reduction Act is that it caps copays for insulin at $35 for Medicare members. This means Medicare members who use insulin will have to pay only $35 a month for this life-saving drug. Before, Medicare members might have paid hundreds of dollars a month for insulin to keep diabetes under control and prevent really bad health outcomes or complications.

Additionally, private insurance plans will now be given the legal authority to cap insulin at $35 if they want to. Currently, members of private insurance plans pay the full price of their insulin until they hit their deductible, which is likely to be thousands of dollars. Starting next year, private plans with high deductibles will have the authority under the IRS code to provide a $35 copay for insulin without breaking any rules. If you have a high-deductible health plan, it will be up to the insurance company, and possibly your employer, to decide to provide that $35 copay for insulin, but it could happen. If Blue Cross makes that decision, I’ll let you know right away.

A Fix for the Family Glitch

Now about the family glitch fix. Any movement? If you remember, when the Affordable Care Act passed, it put requirements on employer health plans. If I were an employer and I had more than 50 employees, I was required under the ACA to provide a health plan that met a federal standard for the range of coverage and a federal standard for affordability for that employee. But there were no affordability criteria for that employee’s dependents or spouse. I could charge them whatever I wanted for their health care coverage.

An employer wasn’t required to subsidize the dependents or the spouses. But, if an employer chose to offer the dependent and spouse coverage, that made them ineligible to buy a policy on healthcare.gov and draw down federal assistance to help them pay for it. They were blocked by the simple fact that the employer offered them coverage through their family member who worked there. So even if they could get a better rate with an ACA plan, they weren’t allowed to buy it.

Under the family glitch fix, which I expect the IRS to encode in the next few months, there will be a household income test for employer groups. It will reinterpret the ACA to allow dependents and spouses of an employee to go to healthcare.gov., They will be able to draw down tax credits and get more affordable coverage than what an employer is offering. That is a very big deal.

Medicaid and the End of the COVID-19 Public Health Emergency

When the Trump administration declared a public health emergency surrounding the COVID-19 pandemic in 2020, part of the declaration included locking down Medicaid. No one could be removed from the rolls until the public health emergency ended.

Technically, the public health emergency is still going on, but we expect it to end sometime in 2023 (barring the unforeseen). Blue Cross and a lot of other health insurance carriers are trying to get ready. When the public health emergency ends, the Medicaid program will have to:

- Start checking incomes of everyone in the program

- Notify them if they make too much money

- Give them an exit strategy if they no longer meet the Medicaid income requirements so they can plan to move to private insurance

There may be 200,000 people or more in Louisiana alone – 11 to 15 million nationwide – who get health care coverage through Medicaid today who will need to be unwound from that program. We expect the income audits to be done over a period of about 14 months. We and other insurance carriers in the state have been working very closely with the Louisiana Department of Health to try to build crosswalks. We want to make it easy for folks to move from Medicaid into private insurance or an employer’s plan (if that is an option for them) without gaps in care. But, this is the largest group of people we’ve ever tried to do that with. So, 2023 is going to be a lot of hard work.

No Surprises Act

Since taking effect on Jan. 1, the consumer protections in the No Surprises Act already have avoided somewhere around 10 million balance bills so far this year. That means that 10 million times consumers were going to get a big ambush bill this year, but they did not receive that bill because of the No Surprises Act. It’s been a rousing success from the consumer side of things.

Medical Marijuana

A caller into Talk Louisiana asked me about medicinal marijuana. I know that’s a popular topic here at Straight Talk, so a brief update.

Nothing has changed, actually. Health insurance, any health insurance, is unlikely to cover any marijuana product that is not approved by the U.S. Food & Drug Administration (FDA). And the FDA has not approved any component of marijuana for prescription drug use, except a highly purified version of CBD oil called Epidiolex that you can get as a prescription. And it’s specifically for patients who have certain types of epilepsy and anxiety. So Epidiolex, as far as I know, is the only marijuana component that has ever been approved by the FDA and is covered routinely by health insurance. It’s on Blue Cross’ formulary.

Whew, that was a lot! But these are all important things that will affect how you and many of our fellow Louisianians buy and use health care. So, thanks for making it to the end! A lot more changes could come from each of these, but one thing is certain – I’ll be here to give you the Straight Talk on them.

Leave a Reply