Of the 4.6 million people in our state, about 1.6 million of them (almost 34%) have a Blue Cross card in their pockets right now. “I have Blue Cross” is something people are very happy to say when they have health needs, need a new prescription, etc. Even for things as simple as their annual check-ups, there is much comfort in saying, when you get asked at the doctor’s office, “I have Blue Cross.”

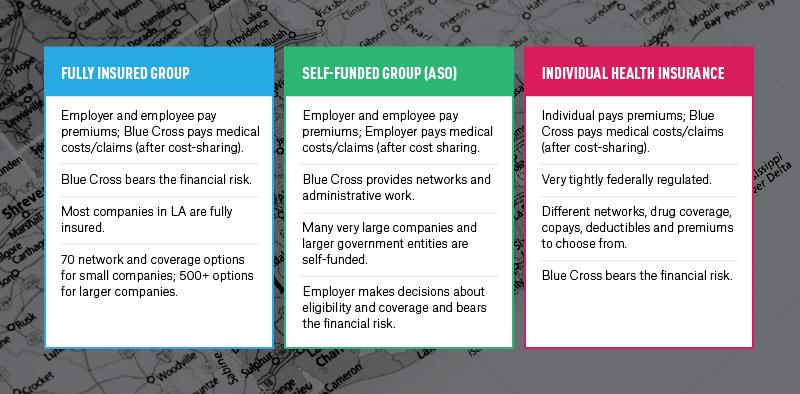

But what does it mean, really? And why isn’t all “Blue Cross” the same? “I have Blue Cross” can mean different things depending on who is bearing the financial risk for your medical care.

In all cases, having Blue Cross means you have access to contracted networks of medical professionals, services and facilities all over Louisiana. It usually means people take you, and your ability to pay for your healthcare expenses, very seriously. It means that your hard-earned treasure will not be devastated by medical bills. It can mean comfort and security when health challenges arise.

Turns out, there are a lot of different types of Blue Cross coverage. In my continuing quest to bring transparency to people who trust us with their premium dollars, I want to talk about that. I believe it can be useful to understand not only what kind of Blue Cross coverage you have, but who administers, supervises, pays for it and makes the decisions for you behind the scenes.

Ever wonder why your particular “Blue Cross” covers some things and not others? Ever wonder why your deductibles and co-pays are at the level they are and who decides? Yep, me too! There are a lot of factors – we’ve talked about how your network affects your plan, but it is also dependent on decisions your employer makes, how your group is funded, federal regulations, etc. Most of the people in Louisiana with Blue Cross (about 90% of them) get their coverage through their employers. When employers sponsor coverage, they can do it several different ways.

Fully Insured Group

Most companies in Louisiana buy fully insured group coverage from Blue Cross. It’s a simple relationship: The employer and employees pay the premiums, and Blue Cross pays the medical costs or claims (after employee cost sharing).

When a company with 50 or fewer employees purchases a fully insured plan, it is federally regulated and called a “Qualified Health Plan.” We offer companies in Louisiana this size about 70 options to choose from. The plans have different premiums, networks, cost sharing, deductibles and copayments. Your employer picks one of the 70 plans, and that determines your copays and deductibles. Then your employer decides how generous he wants to be in contributing to your premiums (we require he pay at least 50% of employee-only coverage, but there are no rules for his contribution to dependent coverage; that’s up to the employer). As an employee, the premiums you pay each month are largely determined by your employer’s contribution to you and your family’s plan.

Since we are going to pay all the medical costs (after cost sharing) out of premiums we collect, all the risk is borne by Blue Cross. If the medical expenses of the group exceed the premiums paid in, we pay the difference, not your employer. All the administrative costs are on us as well.

As companies increase in size (50 and larger), more options are available for them. Many still purchase fully insured group coverage, but since they have more than 50 employees, federal rules don’t limit plan designs, so we offer many more options – in excess of 500! The larger employer can choose fully insured coverage and maintain the relationship in which he pays premiums and we pay all the medical costs (after cost sharing) out of our funds. The advantage of this type of funding is that the employer knows EXACTLY how much he will spend on health expenses during the year. Blue Cross covers the medical expenses no matter how high they become.

Self-funded or ASO Group

The largest corporations and public entities have a third option when offering coverage — they can put themselves in the health insurance business by creating a “self-funded” or “administrative services only (ASO)” plan.

The employer picks out health plan options on behalf of the employee and sets all the rules. He sets premium costs and charges the employees whatever his generosity can support. But this time, when medical bills start to roll in, the EMPLOYER pays the medical costs out of company funds, not Blue Cross funds. Blue Cross is not bearing any risk for medical expenses; we are simply acting as a vendor providing the network of medical providers (with discounts) and the paperwork services of processing and paying claims (with non-Blue Cross funds). We charge an administrative fee per member, which is tiny compared to actual premium payments. If the employer takes in more than is paid out in medical costs, he keeps the difference. If the opposite happens, he’s on the hook.

The employer in the ASO relationship has a “fiduciary responsibility” to make sure everything gets paid. Blue Cross gets a set of rules for the plan, and the employer picks out coverage and sets the premiums. The employer also gets to set eligibility rules, usually along federal guidelines. Although he might hire a second insurance company (a re-insurer) for very high-cost claims, the employer is paying employee medical expenses mostly out of his own money and bearing all the risk. In the ASO model, Blue Cross is not a decision maker, just a vendor for hire who has an excellent medical network and good claims-paying skills.

Many state/local governments, school boards, sheriff’s associations, churches and large companies are ASOs. They want the flexibility to make their own rules about who gets covered and for what. They want to make their own eligibility determinations under federal guidance. They want to reap the benefits if their employees have a “healthy” year, so they assume the risk for medical expenses all year around.

It can be confusing for an employee with health insurance when he hears a decision on some kind of health coverage that is different from someone else “with Blue Cross.” The member likely doesn’t realize that their plan is an ASO and that Blue Cross is not the rule-maker in those situations. The employer sets those rules and is responsible for all changes in the self-funded/ASO relationship. Since the employer bears the financial risk, he gets to set the rules and make the decisions.

Individual Health Insurance

So, that’s fine, but what about people who don’t get health insurance at work?

This is called individual health insurance. When people shop for their own coverage and buy Blue Cross individual health insurance, either through www.healthcare.gov or a licensed agent, they are buying a product wholly owned by Blue Cross under VERY tight federal regulation. Within those narrow rules, we can design products with different networks, drug coverage, copays, deductibles and premiums.

Once the designs are approved by federal officials, they plug them into different metallic levels (Blue Cross offers Gold, Silver or Bronze) and list them on www.healthcare.gov, and off we go! As with fully insured group coverage, individual coverage premiums are collected by Blue Cross and we pay all the medical costs after cost sharing. We bear all the financial risk of the insured population. Within the rules, most decision-making power is still held by Blue Cross, but individual customers who disagree with our interpretation of the rules can appeal to a third party. We set prices and plan types based on the risk of the entire individual population. It’s a very straightforward relationship.

“I have Blue Cross” always mean access to high-quality doctors and hospitals, but it can mean different things depending on the administrative details of your plan. In general, with federal guidance, the entity bearing the risk makes the rules and decisions about coverage. Almost two-thirds of our membership actually are covered by ASO plans through a large employer, which means our role is that of a trusted vendor striving to provide value to the corporate customer and their employees at every turn, not as a decision maker for the plan.

It’s a tricky business. But as always, as a Blue Cross member, you deserve all the transparency we can give you.

Leave a Reply