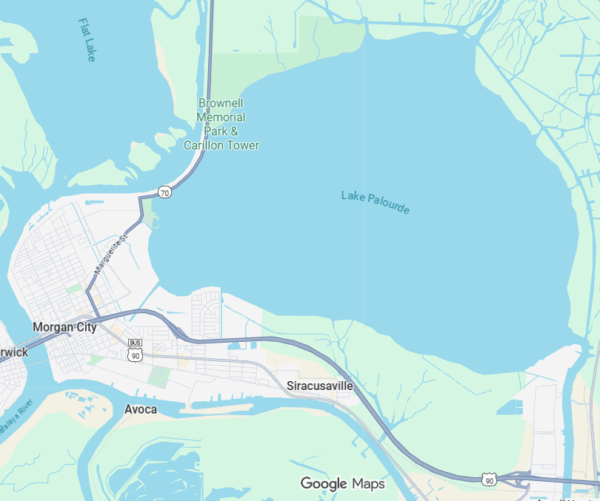

Growing up in Morgan City, you can’t help but notice one dominant feature is a very big lake. It’s called Lake Palourde, and we spent a ton of time on it growing up. One day, my Dad and I were crabbing on the lake, using drop nets and really cleaning up. Within just a couple of runs of about 35 nets, we had 5 dozen crabs in the boat, and they were showing no sign of slowing down.  Dad was in the back, driving our small aluminum bateau. The 25hp motor was running at idle, so I, in the front of the boat, had time to reach down, empty the net, check the bait and replace it into the water without drifting too far off the site where I picked it up. After years of practice, we were pretty good at it.

Dad was in the back, driving our small aluminum bateau. The 25hp motor was running at idle, so I, in the front of the boat, had time to reach down, empty the net, check the bait and replace it into the water without drifting too far off the site where I picked it up. After years of practice, we were pretty good at it.

As we rode along, I could see mullets (the fish) jumping out of the water all around us. They could leap 6 or even 8 feet out of the water! As I bent, reaching for one of the floats to pull in a net, a 2-pound mullet jumped out of the water and smacked me right in the mouth and nose! It hit me so hard I fell backward and saw stars for a bit. I almost blacked out! After my Dad made sure I was ok and not going to fall overboard, we laughed and laughed about that, and kept laughing for years!

“Hit me in the face like a mullet!” entered our family vernacular from that point on to describe when something became very obvious very quickly. Feel free to use that.

Sometimes, it hits you in the face like a mullet

As an economist, nothing gets me going like solving an intricate or challenging puzzle. Like figuring out how money moves through our immensely complex and opaque healthcare system here in the U.S. Sometimes solutions are buried so far below the surface that it’s a real challenge to figure them out.

Sometimes they hit you in the face like a mullet. That’s what’s happening right now.

Without Congressional action very soon, the federal assistance available to the more than 300,000 Louisianians enrolled in health insurance via HealthCare.gov is going to be cut way back. How far back?

How about $1.1 billion?

By my estimate, if Congress fails to renew the current schedule of advanced tax credits on HealthCare.gov for 2026, more than $1 billion in premium assistance will no longer be available for Louisianians to help them afford their health insurance. It’s a drastic cut to our state’s residents who depend on financial aid to have solid healthcare coverage. And, it’s a cut to our state’s healthcare system.

“But Mike, do health insurance companies really need another $1 billion?”

Fair question. Let’s talk about where that money goes once it gets here.

When that $1.1 billion disappears as assistance to help folks pay their health insurance premiums here in Louisiana, here’s my estimate of what will happen:

- $350 million of it will disappear from hospitals, including our already-stressed safety net hospitals and rural hospitals.

- $250 million will disappear from doctor’s offices and places that deliver care in an outpatient setting, like imaging centers, labs and ambulatory surgery centers.

- $300 million will disappear from pharmacies, including independent pharmacies struggling to stay afloat in small towns around the state.

- The remaining $150 million will disappear from the people who administer your health benefits, make sure your claims get paid and keep you enrolled, many of whom live and work right here in Louisiana.

“Ok, so big organizations will lose revenue. What happens to the patients?”

Figuring out how this lack of action by Congress will affect individuals is a bit trickier, but when you see the numbers, it will be a mullet to the face for you, trust me. For example:

- A family of 4 with college-aged children whose income is right at the U.S. average will see the portion of the premiums they have to pay to keep their family covered on HealthCare.gov go up at least $15,000 per year.

- A worker making about $45,000 per year will have to find another $1,550 per year to keep their health insurance.

- A single person, making about $10 hour, will have to find another $900 per year to keep their health insurance.

Facing these kinds of financial challenges, it’s a solid bet that a lot of these folks will either risk going uninsured or drop coverage below what is the best fit for their and their family’s medical needs to be able to afford it. I’ve written before about the potential financial devastation that comes from paying for care out of pocket, and I hate that so many of our friends and neighbors may start seriously considering this option.

I’ve got tons more case studies to demonstrate the pain this looming loss of $1 billion will cause Louisianians.

This is the price of Congress letting these HealthCare.gov enhanced tax credits expire. There is very little time left for Congress to act on this, and I hate to be the bearer of bad news, but honestly …

The Straight Talk is, you don’t have to get hit in the face with a mullet to see how badly this will hurt Louisianians and the healthcare providers and facilities in our home state. Congress needs to renew and appropriate funding for the enhanced HealthCare.gov premium assistance now, or Louisianians will take a painful hit in their finances.

——————————————————————-

And what if the credits aren’t renewed?

To understand how the end of enhanced tax credits may change what you pay, you can use this online comparison calculator from americanscovered.org.

There are steps you can take to make sure you understand your options:

- Check your income:

- You will need to verify your income with the federal government. You may still qualify for tax credits, but they are likely to be lower than before. Even with lower credits, Louisiana Blue offers several bronze and silver Marketplace plans that offer great value while providing the coverage you need. Be sure to read your renewal letter carefully to see your plan options.

- Explore our short-term medical plan:

- Louisiana Blue offers Bridge Blue, our short-term medical policy for Louisianians who want a lower-cost plan for a shorter time. If you qualify, Bridge Blue may be a more affordable, temporary solution if the tax credits are not extended.

- Talk you your employer:

- If you are employed, you should also discuss coverage options with your employer.

- If you’re self-employed:

- If you are self-employed Louisiana Blue offers a variety of affordable small group plan options designed to meet your needs. You should contact your agent to see if you qualify. We strongly recommend that you contact a licensed agent, who will help you understand your options and walk you through the steps needed to get the most affordable healthcare coverage possible.

Leave a Reply