I once heard a radio host say “Dreaming is important. But to do my job, I HAVE to be the mayor of Real Ville!”

I’m totally in on that one. You can’t deliver Straight Talk if you’re not willing to live in Real Ville. This doesn’t mean I like crushing people’s dreams, but there are 1.5 million Louisianians out there walking around with a Blue Cross card in their pockets, and my obligation is to let them know what I think is possible and what I think will make their situation worse.

On Wednesday, Sept. 13, 2017, two very different visions for healthcare in the United States were introduced into the U.S. Senate for consideration. These proposals use two different approaches: The Democratic one creates a single federal plan for everyone and gives the Feds control of the regulations and tax dollars that would fund it. The Republican one returns back to the states healthcare money and authority that was removed by the 2010 healthcare reform law. Seems like we’ve been having this argument forever, right? Today, we’re going to talk about the more progressive of the two proposals and what it could mean for your future. We’ll check out the other, more conservative, proposal in a future blog.

A Single-Payer Proposal

The progressive proposal, sponsored by Sen. Bernie Sanders (D-Vermont) and 15 other Democratic senators, would radically change the way we pay for healthcare in the United States. It would wipe the healthcare payer slate clean and create an entirely new program of funding healthcare.

If it became law, Sanders’ bill would move 325 million Americans into a new health insurance program. Gone would be Medicaid, Medicare (as we know it), private coverage like Blue Cross and employer-sponsored insurance.

Replacing these payers would be a single government entity that we would all be enrolled into (no choice about it) and is designed to replace our current healthcare experience with a risk-free, premium-free, deductible-free, copayment free, co-insurance free, out-of-pocket cost-free experience. In this proposed system, also referred to as “Medicare For All,” you could access healthcare whenever you want without paying a dime.

How awesome does that sound? But, you know what they say about things that sound too good to be true. As your Straight Talk guide, I’m forced to live in Real Ville. Just like you. So here’s my take on some of the issues that arise with this concept.

“Mike, what’s wrong with healthcare for everybody?”

Nothing! That is exactly what I want, too! Blue Cross’s mission is “to improve the health and lives of Louisianians,” which would be easier if we could get them all health care coverage that they want!

But, will this plan get that done? No. It definitely will not. I addressed some of the issues with “Medicare for All” when this idea was proposed during the 2016 presidential election – look here for reference. Today, I’ll break down some issues with the currently proposed legislation.

Just the facts, ma’am

But Mike, why so negative? Can’t we dream a little?

Of course you can! But, as your Real Ville host, I have to remind you of a few pertinent facts. For starters, every single piece of the existing payer system is there for a very good reason and fills a specific need. If you wipe the slate clean, you are going to have to authorize an additional $3 trillion+ a year in spending (that’s just the first year) to Washington, D.C.

That’s the political side. Let’s talk about the real issue here: your money.

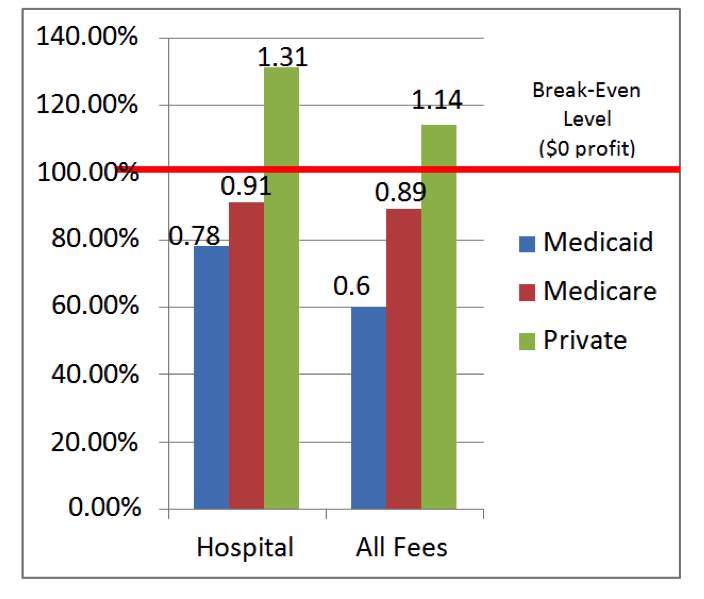

Check out this graph. It demonstrates the relative payment levels for someone using healthcare services, based on which program s/he is enrolled in. On average, medical providers lose money for patients in every program paying below the red line (Medicare and Medicaid). Private insurance, which is the one paying above the red line, heavily subsidizes the other systems.

Milliman “Eve of PPACA”; Clemens and Gottlieb at the National Bureau of Economic Research 2014

This graph demonstrates that, when we look at the nation as a whole, people who are covered through an existing government program pay, on average, below the actual wholesale cost for their healthcare. The red line across the graph is “break-even” (100 percent of costs, $0 profits) and represents the amount of payments healthcare providers need to maintain the current levels of safety, quality, access and capacity in the U.S. healthcare system.

More importantly, you can see the relative payment levels between the different programs. If everyone’s payment average drops below that red line, then cuts in either staffing, capacity, services or access will result. If I want to change the way I pay for healthcare without damaging it, I need to make sure the new total payment system pays at least the red line amount.

You can see above that we already have big chunks of the population who are insured by entities that don’t meet that definition of covering costs (paying below the red line). How many people? Here’s my best estimate as of June 2017:

Census and Kaiser State Health Facts June 2017

Paying Like Medicaid?

You can see from this graph that about 74 million people on Medicaid (23 percent of people covered in the U.S.) are using healthcare, and the doctors and hospitals caring for them are losing lots of money. It’s not unusual for a medical provider to lose between 22 and 40 cents on each dollar’s worth of care they deliver to the 74 million people on Medicaid. If we moved the entire country to Medicaid payment levels, we would expect a lot of medical capacity to disappear, virtually overnight. And you can imagine the effect that would have on safety, quality and accessibility.

So, new question:

“Are you willing to wait an extra month or two (or three or four or five) to see your doctor? Are you cool with access, safety and quality going down?”

This is question #1 for any suggestion to pay like Medicaid.

Medicare is another option

Medicare is a much richer program than Medicaid, designed to care for people age 65 and older, along with those who have certain disabilities or medical needs. About 55 million people are participating in this program today, but this number will grow rapidly as more Baby Boomers turn 65. You can see today they make up 17% of the population.

In general, healthcare providers cannot maintain their current levels of access, safety, quality and services on what Medicare pays, either. I’ve met a few very large, efficient and high-tech l providers who can break even on what Medicare pays them in a good year, but that’s not the case for the average provider. Thus, we already have 40 percent of the U.S. population accessing healthcare and paying amounts that don’t sustain our current quality, safety and capacity in the healthcare system.

Since Medicare pays a lot more than Medicaid, if we moved to a new system that pays like Medicare for everyone, we’d have to move the 74 million people currently on Medicaid up to Medicare payment levels.

My estimate on that is the Feds would need another $300 billion a year on average just to cover that gap, or roughly $3 trillion in new revenue over 10 years. That’s $2,400 in new taxes per American household per year – without covering anyone new. Not one additional person. That’s the money it would take just to bring Medicaid payment up to a spending level that approaches sustainability in American medicine.

This is all interesting, but I want you folks with private health insurance from your employer or individually, all 168 million of you, whether you are with Blue Cross or any other insurance company, to really focus on the third bar on this graph (Private).

That bar above the red line represents how much money you are paying in extra premiums to supplement the current healthcare system and keep it operating at its current quality and capacity for the other 40 percent of the population whose healthcare coverage programs are paying below cost. Under the new “Medicare for All” proposal? You would be enrolled and pay automatically.

What would “Medicare for All” cost?

So, I’ve dumped a ton of info on you today, but all I want you to think about now is this:

How is the “Medicare for All” proposal going to possibly raise enough money to keep our medical system at its current level of access, quality, safety and capacity, when the federal and state government are used to buying care below wholesale costs and letting the privately insured make up the difference?

If private insurance were removed, then all that money you are paying in premiums, deductibles, co- pays, coinsurance and max out-of-pocket costs would have to be converted into taxes so the federal government can keep healthcare going for all 325 million of us. All the money will become a tax — on you, on your boss and on every transaction you ever make. You could end up buying healthcare every time you buy anything else. And you can forget about the massive pre-tax benefits everyone who gets healthcare from their job enjoys today. That’s $250 billion a year that you and your employer save in taxes now that would also be converted into taxes and collected.

This is all why here in Real Ville, I find the concept of the federal government trying to run everyone’s healthcare funding concerning.

I will leave you, as we contemplate the federal government running all of healthcare, with these quotes from a report by the Government Accountability Office on our existing government-funded healthcare, just so you can see how their OWN scorekeepers think they are doing today:

On Medicaid:

“With estimated improper payments totaling more than $36 billion (9% leakage) in federal dollars in fiscal year 2016, CMS needs to improve the effectiveness of its program integrity efforts to help identify and prevent improper payments, such as payments for non-covered services or services that were billed for but never provided.”

On Medicare:

“…it is clear that fraud contributes to Medicare’s fiscal problems. More broadly, in fiscal year 2013, CMS estimated that improper payments… were almost $50 billion (9% leakage).”

Welcome to Real Ville! Decide for yourself, but stay on top of this, right here. Whew! That’s Straight enough for one day.

Addendum

As I stated earlier, I am reviewing the other Senate healthcare reform proposal, which is legislation introduced by Louisiana U.S. Sen. Bill Cassidy, along with senators Lindsey Graham, Dean Heller and Ron Johnson. That proposal, if it became law, would significantly change components of the Affordable Care Act (ACA, the 2010 healthcare reform law). I’ll take a deeper dive on that in a future blog, but you can see some of the issues I addressed regarding new Congressional proposals in this blog from August 2017.

Thank you!!!!

Great information it’s just concerning what will happen

One suggestion how about making these blogs audible !!

We’ve done that! Not for every post yet. Check out the 2nd to last post at http://www.straighttalkla.com

Really… I’ll wait to hear what you have to say on Graham Cassidy bill . I want to see how real’s Ville you are on that

Really fair point! You can count on it,especially if it progresses.

Mike, how much would every household pay if Medicare paid providers the same as private insurers? Would Medicare cost $15K per household? The Feedback I receive is that if the government can charge my household less than what I’m paying now, then I benefit as long as quality doesn’t decrease. So, let’s assume quality won’t decrease and Medicare for all increases my household taxes by 15K. I currently pay 18K in premium and have a $8200 family liability between deductible and coinsurance. I can easily do the quick math and say that I should encourage Medicare for all from that perspective. IF (and that is a big if) quality wouldn’t decrease, how would you say no to at least a 50% reduction in household liability/cost? What would you say to a person like me to convince me that Medicare for all isn’t a good option?

I would NEVER say that Medicare for all isn’t a good option. But Medicare today, as currently configured would never give you the financial results you quoted in your comment. For example:

Medicare Part B has no maximum out of pocket. It requires the member to continue to pay 20% of her medical bills forever, even if the total bill exceeds $1million. Likewise, Part A has a hard cap on hospital days (both annual and lifetime). Once you exceed those days, you are on the hook for either a $500/day copay or the full cost of the stay. Medicare has no prescription drug coverage built in. You must purchase a heavily subsidized Part D plan, which again has very few consumer protections compared to private group insurance.

Turns out that most of the types of protections that private coverage offers, if added to Medicare, would more than eradicate any savings you might glean. AND expose the entire healthcare payment system to Medicare-levels of fraud, waste, and abuse (about 9% leakage each year according to the Government Accountability Office.

So of course, under the conditions you described above, you would definitely want to go there. Is there a path that would actually get you there? Nope.

Hope that helps….mrb

Oh, and Medicare ALREADY costs $12,000 per PERSON per year (not household). Of course, lots of old sick people in Medicare. Ready to join that risk pool?

thanks..mrb