One of the most amazing things I learned at my Dad’s feet was how to forecast the weather.

Yep, that sounds funny to say out loud, but I spent many days on the water with him hunting, fishing, crabbing, crawfishing, skiing or just enjoying our beautiful state. When we were out, especially in the summer, we had to be acutely aware of the weather. The last thing you wanted was to get caught 45 minutes from the landing in a small metal boat during pouring rain or a lightning storm. But of course, that happened to us. We hated to go home once we were out.

Pops would look at the horizon, gauge the clouds for color, motion and electrical activity, and pronounce us “ok” or “in trouble!” Sometimes we would pack up and head for home. Sometimes he would park under a thick tree and wait it out (never the tallest tree, because he believed lightning always struck the tallest tree, which turns out NOT to be true). As a youngster, I can tell you I was often plenty scared. Not so much of what was right in front of me, but of the unknown.

It was always the things you COULDN’T see coming that caused the most anxiety. Like the time lightning struck a tree about 50 yards from us out of a relatively clear, blue sky. It popped, sizzled, burned and scared the heck out of me!

Like the time a huge wind popped up, blowing 50 mph or more, and nearly flipped our boat! Like the time I bent over to pull up a crab trap, and a leaping mullet hit me so hard under the nose that I blacked out. The unknown can be so scary.

My friends who run their own businesses tell me the same thing: “Mike, it’s the surprises I can’t stand. If I know bad times are on the way, I can prepare for them. I have time to figure out a plan, or just pack it in. But at least I don’t get ambushed!”

Amen to that. Which is why I’m giving you the Straight Talk today on what’s happening to your health insurance rates in 2024 and beyond.

It’s Not Just What You Get, It’s WHERE You Go

The healthcare market is changing quickly, and not for the better cost-wise. Blue Cross spends at least 85% of the money you send us to pay for your healthcare services. And since care costs are going up, your premium costs are likely to go up. The care people needed that was covered through their health insurance in 2023, especially the increases in prescription drugs and hospital utilization, is driving big rate increases in 2024.

Why is it costing more for people to get care? Well, let’s start with something called “site of service.”

It turns out that when you need a medical procedure, like chemotherapy or knee replacement or hip replacement or a hysterectomy, WHERE you have that done has a huge bearing on the cost.

We saw three trends that accelerated in 2023 that are causing us worry now:

- An increased demand for procedures like knee and hip replacements, which was not unexpected. A lot of people delayed a lot of procedures during the COVID-19 lockdown and subsequent surges and are getting them now.

- What is unexpected is that patients are heading in droves (or being referred by their doctors) to the highest-cost places to have these medical services. That’s driving claims cost increases that are double our expectation.

- Once patients go to a high-cost setting to get care, they don’t only pay more for the procedure. They also are charged huge amounts of money for the drugs they are given. These drug cost increases were TRIPLE our expectations during 2023, and you will see those rates reflected in your 2024 premiums. And these are the same drugs that lower-cost sites give patients having the same procedures, but the costs are significantly higher at the more-expensive care sites.

What Blue Cross has to pay to cover healthcare services for folks directly affects what you pay in premiums. And these three trends that increased the cost of care caused much of the increases you will see in 2024.

When we look at sites of service across the state, we see mammograms that cost four times as much in some settings as in others. Those most-expensive sites are typically hospital based-or-owned. And we are seeing similar trends, HUGE differences in pricing, in other services like lab work, radiology and colonoscopies. The “where” is often more important in pricing than the “what” or the “why.”

The National Picture

This massive discrepancy in prices between different locations has led to a national call for a new rule called “site-neutral payments.” Congress is debating this, and U.S. Centers for Medicare and Medicaid Services (CMS) is studying it right now.

The concept is very simple: big third-party payers (think Medicare or Medicaid) would set a single price for a single procedure and then pay that same amount no matter WHERE you have it done. I would expect health insurance companies to quickly follow suit once site-neutral payments for government health programs are in place. Since cost-sharing for the average person is now higher every year, the actual cost of those procedures, especially when you have them early in the year, often comes right out of your pocket. Wouldn’t you like to save a few bucks?

How You Can Save Money on Healthcare

The good news is that even today if you need to have a procedure, we’ve made it easy for you to shop around ahead of time and find the lowest-cost option. By using our cost estimator tool, you can then search costs for the care you may need. Just log in to your Blue Cross member portal, and, in a few clicks, you’ll see how different healthcare clinics and facilities in your network compare cost-wise to each other.

You can look up most procedures that you’d need to schedule in advance (colonoscopy, mammogram, MRI, etc.) to compare costs before you go. Keep in mind you don’t have to go to the site of service that your doctor referred you to if you find a cheaper option you want to use. As long as the lower-cost site is in your network, you can ask your doctor to refer you there. Taking the time to shop for these health services can help you save on your out-of-pocket costs like your deductible and coinsurance. And, you can help protect your health insurance rates by choosing wisely.

We work hard every year to project how much more healthcare is going to cost in the next year, and the year after that. We expected increased costs from factors like inflation, labor shortages in healthcare, and higher and higher prescription drug prices. What we didn’t expect was for patients to suddenly start seeking treatment—in larger numbers—in the absolute most-expensive settings. And, we know the cost of getting healthcare services never gets lower. So, taking a few minutes to compare prices online is the best thing we, as patients, can do to make a difference. Keep in mind that spending more money is not buying better care. It’s just more money out of your pocket.

Mike Told Me “You’d Better Shop Around”

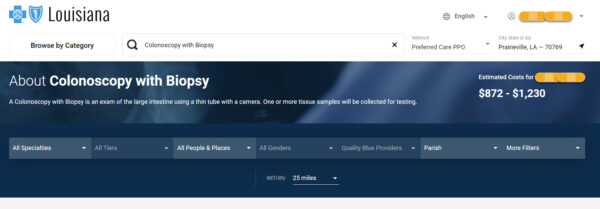

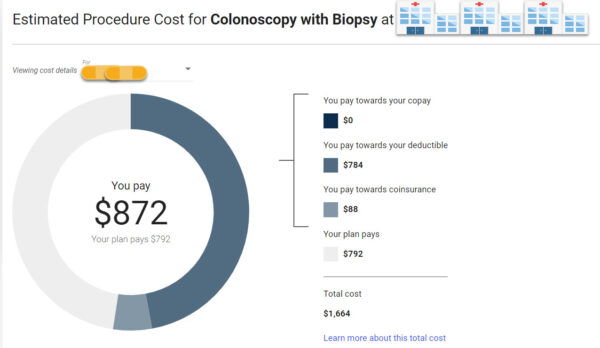

To get real specific about how much more expensive some sites can be, I searched for a procedure I had in December 2023, a colonoscopy with biopsy.

To get real specific about how much more expensive some sites can be, I searched for a procedure I had in December 2023, a colonoscopy with biopsy.

Within 25 miles of me, I found eight sites that do colonoscopies, and all of them were in my network. The cost comparison tool showed me my estimated costs at each location. When I clicked on the provider profile, it showed me what I would pay toward my copay, deductible and coinsurance (whichever is applicable) and what my plan pays. My costs were estimated between $872 to more than $1,200. And Blue Cross would have to pay anywhere from $800 to $4,000! Just based on where I choose to have this procedure!

What do you think would happen to your health insurance rates if everyone started getting the $5,000 colonoscopy and ignoring the other location where it’s just $1,600? Yeah, we sure couldn’t afford that. Now extend that practice to EVERY procedure a person could-get, including knee replacements, hip replacements, chemotherapy treatments and hysterectomies, to name a few. The potential cost increases are staggering.

What do you think would happen to your health insurance rates if everyone started getting the $5,000 colonoscopy and ignoring the other location where it’s just $1,600? Yeah, we sure couldn’t afford that. Now extend that practice to EVERY procedure a person could-get, including knee replacements, hip replacements, chemotherapy treatments and hysterectomies, to name a few. The potential cost increases are staggering.

Unfortunately, these hugely expensive referrals were far too common in 2023, and are continuing into 2024, driving up everyone’s costs. This is leading to some unaffordable rate increases now, which will continue to plague us if we don’t take charge of our own care and start shopping to reverse this trend.

Like storm clouds on the horizon, we’re trying hard to read the signs and let you know as soon as we know how costs are changing. That doesn’t mean we won’t get a stray lightning strike or gust of wind or get hit in the face by a fish (yech!), but we have an obligation to point out when costs are going up too quickly and why, especially when you can affect the costs yourself. And this is happening now.

The Straight Talk is, if doctors keep sending their patients to the absolute most-expensive settings for their treatments and surgeries—whether or not patients realize that’s where they’re going—they’ll be charged many times more than what the cost should be. And rate increases will continue.

A bad moon rising? Trouble on the way? You heard it here first.

I mentioned this years back. Wouldn’t it make sense to have fee schedule across the board like Workers Comp and then the carriers add their own value adds to win your business. As the late Rush Limbaugh would always say, health care is the only sector of business that differs for a person going into a hospital setting based on the payer/ carrier that represents them or if self-pay. May have the exact same service and be next to each other in ER but amount allowed by one could be distinctly different from the other. He would say imagine going to the grocery store and you, the person in front of you and the person in back of you all paid a different price for the same loave of bread. We would be up in arms. Just doesn’t make sense to me either.

I couldn’t agree more. I mean, giving discounts from your pricing is one thing, being forced to sell below cost to certain clients because the government demands you do so is absolutely nonsense. Yet it happens every day.

Watch what happens when I bring in Medicaid and Medicare reimbursements into the mix! Scary!

But you are right on Stacey. The setting should have nothing to do with pricing unless there is a viable quality difference (or at least a perceived one) that affects the outcomes.

Cheers!…mrb

I enjoy your comments. What boils our blood is my wife’s doc is in network but he has sent her for MRI and other docs (not in net) dip in to get a bite….now we “owe” $6K +. Everything was “pre-autho”, but the facility he sent her to was non-net.

So unfair.

Cathy and Roger McIntyre

Roger!

I feel your pain on this one. I actually had a surgery where the in-net gas passer got sick and the sub was out of network. I was out so had no idea until a month later when I got a bill for $3,000!!!

My advice? Take control. Any time any doc refers you to anyone for anything refuse to show up until they verify everyone is in your network. Your are protected in emergencies by the No Surprises Act but some providers are quite adept at getting around the rules and charging you many times what their service is worth.

It also helps if you can afford a Blue PPO plan as they have the biggest networks available.

Hang in there!

Mrb