Way back in the year 1670 (that’s 355 years ago, for those of you keeping score), an English theologian and deep thinker named John Ray published a book with this quote:

“The road to hell is paved with good intentions.”

He was quoting an English proverb that was probably some 500 years old. This proves once again that the deepest truths are so embedded in the human psyche that they tend to come around over and over again as we “rediscover” them.

The latest rediscovery of this saying? I’m thinking about the No Surprises Act, which will celebrate its fifth anniversary of congressional passage in December.

You may recall I’ve written about this legislation extensively, with the latest version here.

“So Mike, What’s the Problem? We Thought the No Surprises Was a Good Thing!”

Great question. As the proverb states, the intentions in passing this act were certainly good. That’s why I’m writing about intentions versus enforcement vs outcomes today.

Despite the good intentions of its authors, this act has gone off the rails from an enforcement perspective. And it is driving billions of dollars in illegitimate costs onto the price of YOUR health insurance premiums. And your employer’s as well.

The idea behind the No Surprises Act was simple:

Consumers shouldn’t have to get involved in billing disputes between out-of-network providers and insurance companies for care during an emergency.

The act was supposed to insulate patients seeking care in a bona fide emergency from worrying about whether the medical provider who showed up to treat them during that emergency was in network or out of network. Simple, right?

It was. Until we got to the mechanism where those out-of-network providers still want to get paid, no longer based on insurance company rates, but on rates provided by third-party intermediaries. These Independent Dispute Resolution providers, or IDRs, have turned out to be outrageously high priced.

Worse than that, the policing of the IDRs setting the reimbursement prices is so poor, and their workloads are so outrageously high, that national surveys by the Blue Cross Blue Shield Association, in conjunction with America’s Health Insurance Plans, have revealed startling and very expensive problems.

Let’s start with the fact that some 40% of all the claims that out-of-network providers submitted for resolution were INELIGIBLE FOR PAYMENT under the No Surprises Act.

Table 3 from “New AHIP/BCBSA Survey Finds Providers are Flooding IDR System with Ineligible Disputes”

Yet insurers paid almost half of those demands for higher rates anyway. In error. And getting the money back is next to impossible. And since insurance companies have to spend the majority of the money they take in on healthcare services for their covered members, these overpayments are coming out of your money and driving up premiums.

What’s that in real money that your premiums are bearing in the real world, incorrectly?

Try $5 BILLION. That’s how much these out-of-network providers have received that you should never have had to pay.

It turns out, some private equity investors who own medical provider businesses (like stand-alone emergency rooms that refuse to join any insurance company networks) have discovered they can flood the IDR process with millions of ineligible claims and get paid big money by the arbitrators. And they have.

Insurers nationwide have seen payments as high as (get this) 23,000% higher than the in-network rates we pay our contracted providers for delivering the exact same medical services. We routinely see arbitrated payments at 400-500% of contracted rates, or Medicare rates being awarded to these for-profit companies who will never join any insurance company network because they are getting rich by flooding the system. Claims that were clearly nonemergency situations were processed and paid like emergencies.

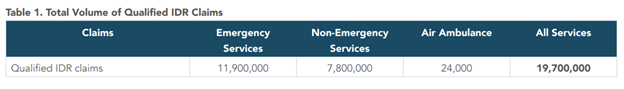

The original No Surprises Act arbitration process was built to process 17,000 claims per year. Last year, that process was flooded with 20 MILLION claims, a significant percentage of which were submitted by bad actors gaming the system at your expense. And imagine almost 20% of those poor-faith submissions being paid out of your premium dollars. That’s your money!

Table 1 from “New AHIP/BCBSA Survey Finds Providers are Flooding IDR System with Ineligible Disputes”

Furthermore, what does this situation say about our in-network providers, who have stuck by us and our members? Providers who participate in an insurance network demonstrate a commitment to stability and fairness that benefits everyone involved — including our members. We create our provider networks on the promise that they will have access to steady business from our members, and that we will compensate them fairly for the services they perform. That promise extends to our members, who can work with healthcare providers they can trust and receive the best care for their premium dollar. People working outside of that system and taking advantage of it to make even more money just doesn’t sit right with me.

The Straight Talk is, money that you pay in premium dollars, which should mostly be paying for your needed healthcare services, is being vacuumed up into a broken process where fraud, waste and abuse are rampant. Improper payments gobbled up at least $5 billion in 2024. In no way should you be paying for this. Federal regulators have the tools to fix this broken process and need to do so immediately.

Leave a Reply