The fastest-growing part of your health insurance premiums may not be immediately obvious to you. It’s not hospital costs or doctor’s costs or the cost of lab services, X-rays or surgeries. The answer is spellbinding…

It’s drug costs. Plain and simple.

There are many things driving this rapid cost increase. In Louisiana, for example, salaries are going up about 1.5% per year and insurance costs are going up 5-8% a year, but the amount spent on prescription drugs rose 13% last year, without much change in the number of traditional medicines filled. That’s far ahead of what any of us can afford year in and year out.

While some of this increased amount spent on drugs makes sense to us, some of it is downright hocus-pocus.

We can certainly justify a company spending billions of dollars on research and development to develop a cure for a dreaded disease affecting our friends and neighbors. And then, when that drug hits the market at $5, $10 or $20,000 a month, we are hesitant to complain since it is clearly saving lives.

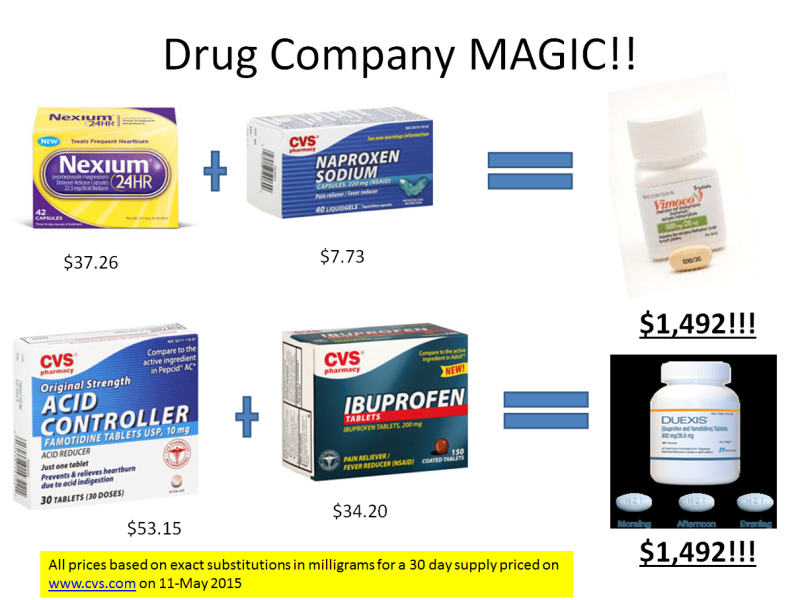

But when a drug company takes two common, often over-the-counter, ingredients, blends them together, repackages and repurposes them, markets them directly to patients and doctors and sets the price at 1,000 times the costs of those two or few drugs, it makes perfect sense for us to complain.

Imagine I send you to your local drug store and instruct you to buy a few over-the-counter ingredients – $37 worth (at retail) of esomeprazole (think Nexium®) and about $11 worth of naproxen (think Aleve®). These $48 worth of ingredients are what you will find in a 30-day supply of a new drug from Horizon Pharma called Vimovo®.

After this drug company works its magic, a new price is set. What’s a fair price for this combination? Remember drug companies can get these ingredients for a LOT less than you can, and there is nothing new here – just mashing together two existing over-the-counter drugs.

So what’s fair? $40? $60? $100?

Try $1,492 for a 30-day supply.* That’s what Horizon charges for Vimovo.

Lest you think I’m just picking on them, let’s do it again.

This time in your shopping, I want you to purchase $53 worth of famotidine (think Pepsid AC®) and $34 worth of plain old Ibuprofen (Motrin®). This will get you a 30-day supply of another new drug called Duexis. So, what’s a fair price?

Horizon’s answer? Again, $1,492 for a 30-day supply. The same magically unbelievable amount.

You might think, “Who on earth would pay for such a drug, and what doctor would prescribe it?” Last year, Louisiana doctors prescribed – and patients filled – these drugs more than 5,000 times, and the number is climbing each year.

To discourage this, Blue Cross raised co-payments for these drugs. We also sent educational materials to doctors in our networks and our members about the high cost of these drugs, and advised them to consider lower-cost alternatives that would be just as effective. Horizon responded by sending out coupons to cover the co-payments. Even at $100 per co-payment, they could clear more than $1,000 each prescription for just a few dollars of commonly available over-the-counter ingredients.

In this example, this one drug company paired two common, inexpensive drugs together and poof! We have one magical drug with a price you almost have to see – or buy – to believe.

This is one big reason why premiums go up each year. You cannot afford this behavior. Neither can our healthcare system. Neither can Blue Cross and Blue Shield of Louisiana.

Drug Company Magic, indeed!

*Approximate prices according to www.cvs.com as of May 11, 2015.

Leave a Reply